Successful retailers were able to improve operational performance and boost sales by leveraging insights, new product development and staffing. Are you doing all you can to optimize your B2C efforts?

The Jan / Feb 2017 Harvard Business Review features a study titled “Curing the Addiction to Growth” by Marshall Fisher. It is written for the Retail sector but applies to many others as companies shift to drive more revenue from existing operations (stores) as opposed to growing revenue through establishing or acquiring new stores. In the article, Mr Fisher explains that successful retailers were able to improve operational performance and boost sales by leveraging insights, new product development and staffing. These are all areas where client’s across many industries have tapped into the value that deploying a Mobile Research and Data Collection platform like Twentify’s can provide throughout a brand’s maturity cycle. The write-up that follows explores that connection with a real use-case from an established European retailer, one of Twentify’s many retail customers.

Are you doing all you can to optimize your B2C efforts?

Lessons from the Retail Industry & Their Implications for Market Research

Fueled by Wall Street and a capitalist culture, the retail sector in general has been obsessed by top-line growth. This pursuit of double-digit revenue growth over the years has led many retailers to relentlessly open newstores. As attractive sites become scarce and new stores begin to cannibalize existing ones, growth falters. Faced with such declining growth, some retailers couldn’t find ways to change course. As a result, chains like Circuit City, RadioShack, Loehmann’s and the Sports Authority ended up in the retail graveyard. Analysis conducted by Marshall Fisher from the Wharton School and featured in HBR’s Jan/Feb 2017 issue, showcases that mature retailers that have focused on growing revenues of EXISTING stores instead have fared much better than retailers that have mainly relied on store expansion. More specifically, the overperforming “above-average” mature retailers slowed their store-opening rates and focused on improving operations and margins of existing stores. This grew revenues faster than expenses and led to stronger operating profits overall. “They grew their operating profit 8% a year, on average — more than eight times the rate of the unsuccessful ones — and their average annual Total Shareholder Value was a whopping 21.9% over the five-year period”. The table below summarizes the path taken by these companies towards improved profitability within a slow growth environment.

This “stop opening new stores” or “boost sales from existing stores”strategy may seem like a simple one, but it covers many important layers/components. Successful retailers were able to improve operational performance and boost sales by leveraging insights, new product development and staffing, among others. Take insights for instance — The extent to which customers were able to find products they wanted at a reasonable price and got help from sales associates was a crucial determinant in customer satisfaction and retention. The retailers that achieved positive increases in comparable store sales relied on their ability to track insights regarding competition and changing market conditions while making sure that they stocked the right products/items on their shelves. Additionally, retailers seeking improved sales at existing stores often developed new and timely products to boost revenue. To do so effectively, retailers used highly disciplined methods for identifying/testing potential offerings/improvements and assessing customers’ changing needs or habits. Lastly, the retailers in question were able to train field staff effectively, meaning new hires were able to relay the right messages under changing market conditions.

Central to navigating/managing all these layers/components is the critical ability to collect rich, timely and insightful data, based on a customer’s journey. Aware of the big stakes, retailers are forced to look into ways to collect data/insights in innovative, efficient and reliable ways to help manage staffing, improve product management decisions and optimize SKU stocking or apparel designing. Historically, retailers turned to internal employees, marketing agencies or research firms to gather data, using trained personnel to conduct opinion surveys, store visits or mystery shops. These methods, however, often took too long to generate meaningful results, or could not be run frequently enough without introducing bias, and were expensive. But, most importantly, they struggled to capture the voice-of-the-customer and a balanced view of their shopping experience. Consequently, retailers are increasingly augmenting or replacing their traditional means of collecting vital data in order to adapt to the shifting retail landscape.

Positioned within the context of transitioning from ‘traditional methods’, progressive retailers have increasingly turned to what is becoming known as mobile research and data collection to address their evolving data needs. Under this scenario, retailers get to ask and capture in-the-moment answers to open ended questions of consumers — exposing their behaviors, preferences and habits — and unlock tremendous value beyond traditional retail KPI’s. Such results and methodology is based on using a crowdsourced group of people (consumers) to be the eyes and ears where and when they are needed. Simply, here is how it works:

- A motivated group of users (everyday consumers) are looking to make some extra money, with..

- an engaging smartphone app loaded on their iOS or Android phone, who..

- receive jobs or tasks, pushed to them via a platform, based on a client’s needs.

Armed with this capability, retailers of all kinds — from mono-brand fashion retailers to grocery chains — can ask and get quick, affordable and contextually rich answers to open/close-ended questions such as:

- Are my stores displaying appropriate branding and promotional materials?

- Are my stores carrying and displaying the right stock/SKUs correctly, at the time?

- What do my consumers think of a recently released collection and the promotions associated with it?

- What do my customers think of store staff interactions?

All these questions and many more can be easily answered in a matter of hours or days using a mobile research and data collection solution. Twentify, an exciting young company, has such a solution. With a crowdsourced user base of over 300,000 and operations in North America and Europe, Twentify has run projects in multiple countries for leading global brands like Puma, Carrefour and Coca-Cola. Whether it is through a mystery shop, a store audit, or an opinion survey, retailers can be aware of in-store operational inconsistencies, uncover consumer preferences or assess staff performance. Twentify’s suite of mobile/field market-research solutions give retailers what they need to protect and drive their brands.

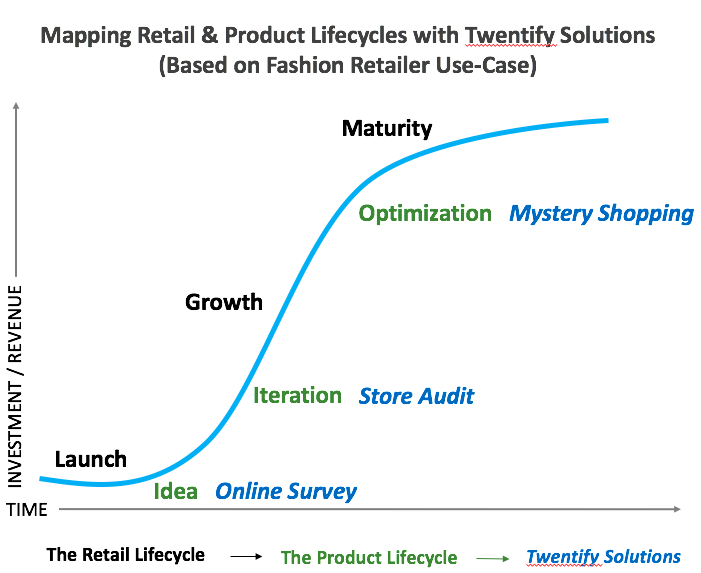

One such evolutionary example/use-case can be found with a leading European fashion retailer, with 319 stores, focused on multi-season, fast-fashion. Utilizing multiple Twentify solutions consecutively, the client initially deployed an Online Survey to gather insights for an upcoming collection, focusing on style preferences and habits of a target demographic. Armed with these results, the retailer launched their new collection under heavy promotion. The next step was to monitor displays and in-store promotional activities with Twentify’s Store Audit solution. The last piece of the project was focused on getting consumers to weigh in on the impact of promotions and assess the performance and knowledge of outlet staff which was accomplished using Twentify’s Mystery Shopping Solution. The combination of all three solutions produced such a revealing base of data through the product lifecycle that the retailer has chosen to deploy it for all new products.

Conclusion

This article is not meant to draw a hard line between poor performing retailers and those that do not use a crowd/mobile based market research solution. To join the ranks of the successful and mature retailers, making a switch from an expansion to a leverage strategy is a huge challenge. It often requires infrastructural, strategic and organizational investments that come with focusing on the nitty-gritty work of improving operations. But no matter what, such operational mastery eventually requires optimized and timely usage of data/insights generated by real consumers and customers. And as retailers find themselves navigating this ever-evolving market/field research/survey terrain, they should bear in mind that the relatively low cost associated with mobile research and data collection is only one element of the benefit. Rather, the value comes from using a crowdsourced group of consumers’ judgements, perceptions and experiences; allowing retailers to take on new opportunities, mitigate risks and move faster.