AIn the last couple of years, Turkey has become one of the most intriguing markets for the booming e-commerce industry. Since the first report we published on Turkish e-commerce in 2018, a lot has changed. Last year, e-commerce giants have gone through many milestones, including Trendyol’s $350 million investment from Alibaba, Getir’s European launch, Hepsiburada’s Nasqad move, on-demand delivery investments by FMCG giants, and more. Adding the pandemic’s life-changing new normal, online and mobile shopping have become the mainstream way of buying things in the country.

Expectedly, the supreme force behind the transformation was the pandemic and the lockdowns that came with it. In the first couple of months, e-commerce marketplaces saw a drop in the clothing category. In contrast, the demand for FMCG, self-care, and electronics has been blasted.

E-commerce adoption may have been caused by the pandemic in the first place, but today, we see that consumers from many demographics prefer online shopping over a short trip to the mall or a store. The post-pandemic world doesn’t look like a place where people will abandon their convenient online habits, especially if we’re talking about the younger generations of shoppers.

Last year, e-commerce in Turkey skyrocketed thanks to the boom in personal internet use, which has risen as high as 79% of the population.*

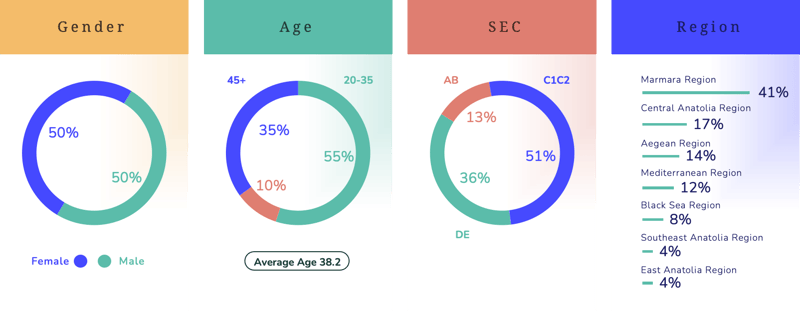

In this year, the research has been conducted with 2,185 respondents who are 20-year-old and over, who claimed to have used one of the four major e-commerce marketplaces, HepsiBurada, Trendyol, n11, or GittiGidiyor, at least twice in the last year. This year, we broadened our segmentation with behaviors of X, Y, Z generations in eight main areas of e-commerce: clothing, FMCG, Books, Music & Video, Cosmetics, Electronics, Mother & Baby, and Pets. The research was conducted on Twentify Bounty app using Mobile Research Methodology. We measured consumers’ e-commerce usage, experiences with e-commerce brands, brand awareness, category preferences as well as e-commerce brands’ conversion rates, exclusive customer rates, and experience scores with all details in our 152-page report.

Profile of respondents

Turkey’s E-Commerce Habits in Numbers

Our detailed research has given us a viable insight into the distinct divisions in the online shopping habits of Turkish consumers. The first things that catch the eye are the market domination of Trendyol with an 81% visit rate and Hepsiburada with a competitive 80%, and that their target customers seem to vary.

The fastest-growing e-commerce platform in Turkey, Trendyol, has a customer base of the younger generation and women. On the other hand, its strongest competitor Hepsiburada is the choice of men and people over 35. When it comes to brand awareness, Trendyol once again dominates the market with 93% awareness among female customers. On the male customer front, we see n11 with 88% brand awareness.

Registered Customer Rates and Loyalty Scores Have a Clear Link

One of the top priorities of e-commerce giants in Turkey is creating new ways to increase customer loyalty. As expected, the first step to building a healthy loyalty program is to get customers to sign up in the first place.

Our report shows a similar pattern for all the e-commerce leaders in Turkey, with an almost 100% active shopping rate on registered platforms. According to our E-Commerce in Turkey 2021 report, registered shoppers create a distinction. 98% of Trendyol, 98% of Hepsiburada, 96% of GittiGidiyor, and 99% of n11 registered shoppers have purchased from the marketplaces at least once. When it comes to returning customers, Trendyol seems to have built the best loyalty program with a return rate of 89%.

What do Turkish Consumers Prefer to Buy Online?

When we look at our report, we see that the clothing and accessories category sits at the top of the chart of the online shopping preferences in Turkey. Surprisingly, cosmetics and personal care follow, in front of electronics which comes in third place.

Our report, curated at the moment of decision making, dives deeper into customer preferences and behaviors while shopping through the following sub-categories:

Clothing

One of the biggest competitions between conventional and online shopping has been in the clothing category in 2020. In particular, the competition in the categories of footwear and outerwear has become fiercer than ever. Shopping frequency has risen in the clothing category as well, reaching 2.4 times per consumer each month.

Cosmetics and Personal Care

The second-biggest category in online shopping in Turkey is cosmetics and personal care. In this category, we see a profoundly integrated consumer profile with their pre-acquisition inquiries. Although the target audience of the category seems loyal to Trendyol, the e-commerce giant still hasn’t reached the top in terms of reputation.

The second-biggest category in online shopping in Turkey is cosmetics and personal care. In this category, we see a profoundly integrated consumer profile with their pre-acquisition inquiries. Although the target audience of the category seems loyal to Trendyol, the e-commerce giant still hasn’t reached the top in terms of reputation.

Electronics

Another category where preference for online shopping in Turkey is rising is electronics, which has created its own set of rules, especially during the pandemic. Consumers of the category prefer to see products in real life, but on the other hand, waiting for online sales is a growing trend.

Another category where preference for online shopping in Turkey is rising is electronics, which has created its own set of rules, especially during the pandemic. Consumers of the category prefer to see products in real life, but on the other hand, waiting for online sales is a growing trend.

FMCG

Fast-moving consumer goods were one of the quickest growing categories in Turkish e-commerce, and one of the main reasons was the new under-10-minute delivery model. With this, Getir may have transformed the way people shop for FMCG products, but Migros still leads the game. Newcomers, like Trendyol and HepsiBurada, are making bold and surprising moves as well.

Fast-moving consumer goods were one of the quickest growing categories in Turkish e-commerce, and one of the main reasons was the new under-10-minute delivery model. With this, Getir may have transformed the way people shop for FMCG products, but Migros still leads the game. Newcomers, like Trendyol and HepsiBurada, are making bold and surprising moves as well.

Mother and Baby, and Toys

E-commerce platforms have become the go-to places for parents that seek an economical way to shop for their children from every demographic. Surprisingly, the category has its own star platforms.

E-commerce platforms have become the go-to places for parents that seek an economical way to shop for their children from every demographic. Surprisingly, the category has its own star platforms.

Music & Video

Online music and video acquisitions have long been shifting towards streaming, but the Turkish consumer still seems to prefer the old-school in many cases. According to our report, 37% of participants stated that their spending in the category has risen during the lockdowns.

Online music and video acquisitions have long been shifting towards streaming, but the Turkish consumer still seems to prefer the old-school in many cases. According to our report, 37% of participants stated that their spending in the category has risen during the lockdowns.

Books

One of the strongest fronts on Turkey’s e-commerce market has been the book category. Online bookstores like D&R and Kitapyurdu seem to be building strength even in a market where the global leader, Amazon, has accelerated its online bookstore operations.

One of the strongest fronts on Turkey’s e-commerce market has been the book category. Online bookstores like D&R and Kitapyurdu seem to be building strength even in a market where the global leader, Amazon, has accelerated its online bookstore operations.

Pets

One of the most pet-friendly nations in the region, Turkey, favors online platforms more and more every day for their furry housemates. We can safely say that cats are not only taking over YouTube but also the e-commerce arena, with 57% of participants in the category stating that they buy cat food from online channels regularly.

One of the most pet-friendly nations in the region, Turkey, favors online platforms more and more every day for their furry housemates. We can safely say that cats are not only taking over YouTube but also the e-commerce arena, with 57% of participants in the category stating that they buy cat food from online channels regularly.

Explore every detail of consumer preferences and habits in eight different categories, including gender, age groups, income groups, and more. Get your free copy here or get in contact with us for more information.

Sources: *The Turkish Statistical Institute (TurkStat), Information and Communication Technology (ICT) Usage Survey 2020